International finance funds have recently landed in Spain to take advantage of post-housing-bubble ‘bargains’. With very bad consequences for people affected by the crsis, the international commission of PAH said at the occasion of the MIPIM 2015.

In reality these the debts in Spain result from soaring unemployment and inevitable mortgage default, and risk making thousands homeless. According to Spanish law families or individuals lose their homes but do not lose their debts. In addition, individual bankruptcy is not possible in Spain. Banks, like Catalunya Caixa (CX), have received billions of euros in taxpayers’ money, part of a bailout agreed in cahoots with the European Troika. An old tale Europeans know well after six years of ‘crisis’: privatize the profits, socialize the losses.

As if cuts to our welfare system were not enough, international financial giants are landing in Spain to take a piece of the pie. Blackstone is one such player. As the world’s largest private equity specializing in real estate, it has recently bought 94,000 mortgages from CX, an institution that received 12 billion euros ($15.4 billion) of taxpayer’s money as a bail-out. The Blackstone modus operandi – buy cheap, resell dear -is already manifesting as rising rents and numerous evictions everywhere they set foot.

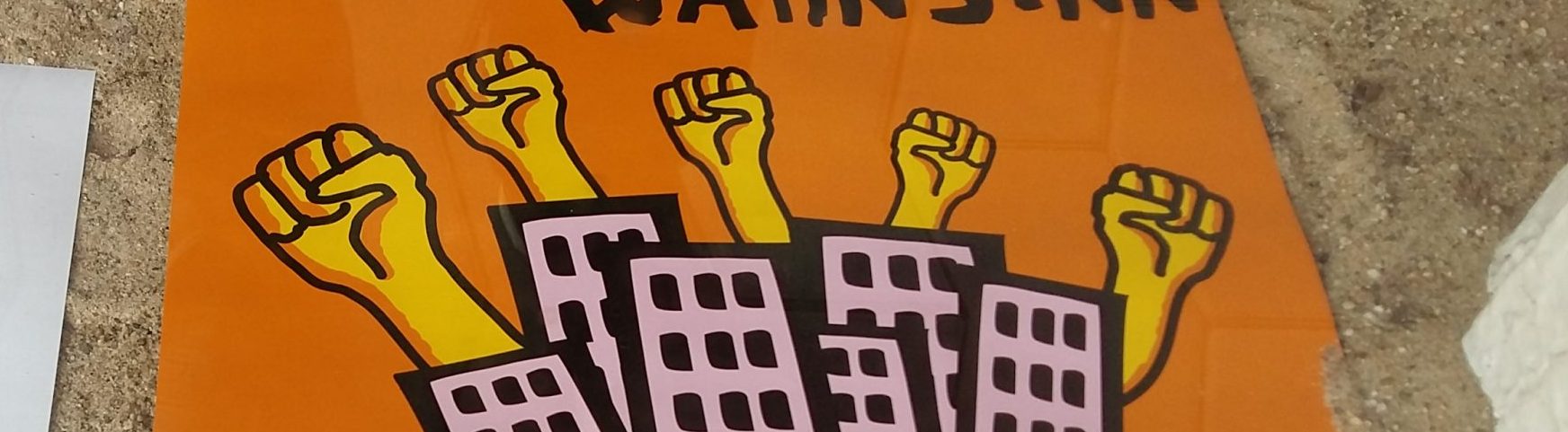

Spain has one of the lowest European rates of social housing available (under 2 per cent) and what little is left is being sold to finance funds like Blackstone, through its Spanish subsidiaries. We will not watch our homes get sold off at huge discounts that were never available to ordinary citizens. We will not let them gamble our social housing away. We will fight back!