25 YEARS MIPIM – 25 YEARS OF PRIVATISATION

In Germany rental housing is more important than in most other countries, especially in the cities. In the Ruhr metropolitan area nearly 68 % of all housing units are rented. Most of the buildings in this region were constructed during the decades of industrial growth, by coal and steel companies, trade unions and municipalities as part of the non-profit-housing-sector. When the national government in 1989 abolished a law which protected non-profit-housing from being sold out, it opened the way for a deep process of commodification and privatization of the existing housing stock. At the same time German governments alongside with the EU also liberalized financial markets.

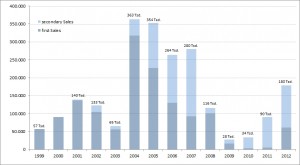

Larger sales of housing stocks in Germany 2000-2012

When the global housing bubble started after 2000 transnational financial investors soon became attracted by principal offer the huge stocks of mass housing. To them the high portion of rental housing looked like a huge potential for privatization, comparably low rents gave reason to expect high rent increases and high vacancy rates looked like an easy way to improve the performance. Many public institutions, municipalities and industrial companies in Germany sold their rental housing stocks to those transnational financial investors. Approximately 900.000 housing units today are under direct control of financial investors, many of them have been traded more than one time. The quantitative effects concentrate on particular cities and regions in Germany, especially cities in the Rhine-Ruhr area.. In Dortmund every 5th rental flat is under control of the financial markets, in other towns it is 10 %.

The new “investors” financed their buy outs with little equity and huge loans which were placed on the (often repaid) properties as mortgages and then refinanced by complex and very big (partly over 6 billion) securitizations. These securitizations very much influenced the business models. The new landlords had to follow the limits set by the loan conditions. The whole housing business, any aspect, became a function of finance.

The consequences for the tenants and the housing stocks were and are disastrous: Forced to extract high returns and interests the landlords heavily reduced the maintenance of the aged housing stocks and the work force in their management. Tenants are suffering from defects in heating, from humidity, not working escalators or not available garbage services. The obligatory annual balances for service fees are often wrong or the landlord does not present them at all. In a raising number of cases water and energy supply was questioned because the landlord did not pay. Service providers often are change, sometime the tenants do not know who is responsible at all. A part of the companies “defaulted”. Some housing “portfolios” with important housing schemes in disfavored satellite towns today seem captured within an endless loop of asset-stripping.

To these and other problems with the consequences of the financial business-models organized tenants reacted with protest. Media covered their daily stories. Soon broad criticism from various sectors of society, especially in the Land NRW, mad it a political issue. Tenant associations organized advocacy and public pressure, which during the NRW elections 2010 led to promises by the Greens and the SPD. The main reaction was a parliamentarian commission which for the first time intensively studied the business models of the new investors and its consequences.

After more than 2 years of work the commission presented a voluminous report with studies and a list of political proposals. Meanwhile one of the proposals – a stricter law on municipal control of badly maintained housing – is passing the parliamentarian process. But many municipalities are deep in debt. They hardly will implement the new instruments. And the same time public banks and governments in other Länder have continued to sell housing companies to private business with relation to financial investors.

For some years it seemed that a couple of large securitizations for mass housing debt, which were created between 2005 and 2007 would fail to fulfill repay-obligations in 2013. But then the crisis of sovereign debt in southern Europe led to an escape of international capital to more “secure” investment opportunities, which some of them are finding in German real estate. This demand for investment assets at low interest rates made it possible that nearly all large securitizations which ended in 2013 could be repaid and refinanced by new loans. And at the same time these new conditions at international capital market allowed the exit of the invested funds.

Three huge investment platforms started their IPO during the last 18 months and are now publicly traded housing companies. The new shareholder structures meet a rapidly changing market. Accessible housing had become rare in prospering cities and rents are rocketing. The new financial situation as well as the housing market environment now leads to shifts in the strategies of the investors. Rent increases and expensive modernization are becoming another thread for the tenants.

It is typical that nearly all of the financial “investors” which have been active in this business as well as the municipal agencies of those cities who have been heavily affected by the business – Dortmund, Bochum, Düsseldorf, Cologne – visit the MIPIM 2014. They hardly will negotiate a return to non-profit housing. The financial investors are mainly looking for new shareholders and other exit options. The municipalities who are under pressure by high deficits continue to sell our land and infrastructure. We, the inhabitants, have to pay the prize. For ever?