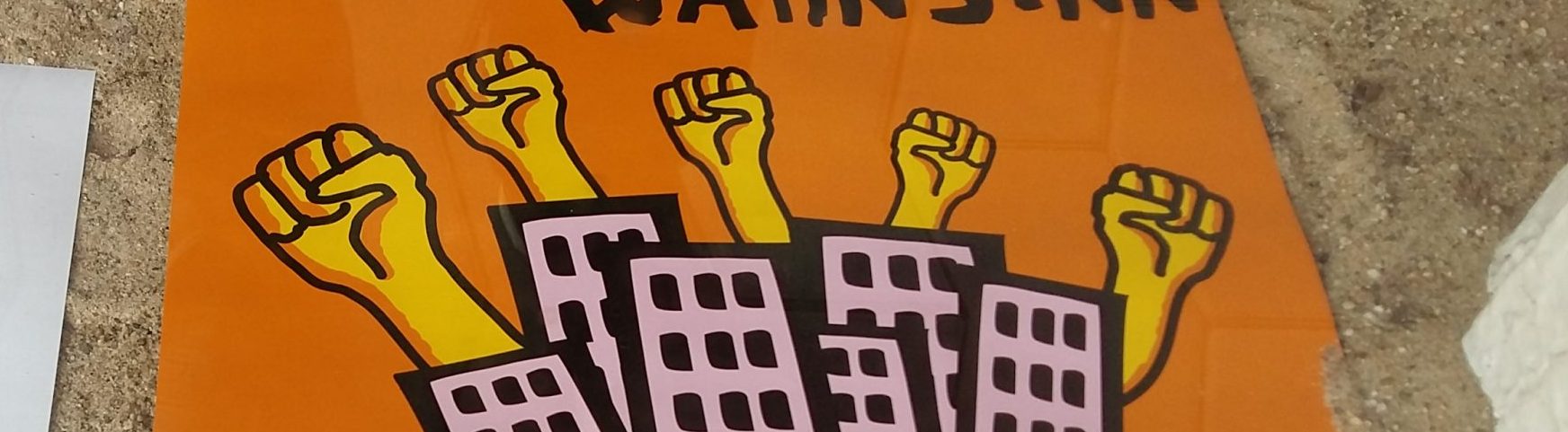

MIPIM IS WHERE THE BIG BAD LANDLORDS MEET

During the years of the global housing bubble 2003-2007 many public institutions, municipalities and industrial companies in North-Rhine-Westphalia sold their rental housing stocks to transnational financial investors. Many houses were sold several times, some companies failed. Here is a selection of 5 important “investors” who attend the MIPIM (directly or through a parent company). Together they control nearly half a million housing units in Germany.

Deutsche Annington Immobilien SE, Bochum

179.000 units, 99.000 in NRW |11 bn € total assets, 3,3 bn € equity | 2260 employees

Partial exit of Terra Firma-Funds through IPO July 2013. Principal shareholders: Monterey Holdings SARL (Luxembourg,-SPV of TerraFirma Funds): 84,4 %, Norges Bank (Norway’s central bank): 5,4 %

Deutsche Annington, the housing platform of the British private equity manager TerraFirma Capital Partners, is the largest German landlord and a “pioneer” of strategic Real Estate Private Equity in German mass housing. After buyouts of workers estates from the federal railways (2001, 64.000 units) , the E.ON company Viterra (2005, 138.000 units) and other industrial portfolios it today controls 179.000 own housing units at various places in Germany, with a focus in the Ruhr district (99.000 units in NRW). During various strategy-changes Deutsche Annington became famous for its problematic reduction of maintenance and of the number of employees. Especially in 2008, when Annington tried to replace traditional facility services by a centralized call center, many tenants were frustrated and vacancy rates rose. The Viterra buyout in 2005 was re-financed by the so far largest securitization of residential property in Europe, the” GRAND plc” with a volume of 5,4 bn € and a period until 2013. After intensive negotiations with the creditors Annington managed to refinance it in 2012/2013. After that big step TerraFirma started a partial exit via an IPO in summer 2013. With easier access to fresh capital Annington now is trying to implement a portfolio strategy where parts of the housing stock gets modernized, which means rising rents.

LEG Immobilien AG, Düsseldorf

95.000 housing units, all in NRW |5.2 bn € total assets, 2 bn € equity | 900 employees

Exit of GoldmanSach/Whitehall Fund since IPO February 2013. Principal shareholders: Global asset managers like Black Rock (12,3 %), MFS/Sin Life (5,4%) Morgan Stanley (3 %), Perry Capital(7%), free float 61, 5 %

The “Landesentwicklungsgesellschaft NRW” originally was a state owned company for urban renewal and housing. In 1987 it took over significant parts of the bankrupt trade-unions’ housing company “Neue Heimat”. The housing stock includes many (former) social housing estates from the 70ies. In 2006 a conservative-liberal government decided to sell the company. Against this plan a plebiscitary initiative collected more than 63.000 signatures. Nevertheless the government in 2008 sold it to a consortium of funds, mainly controlled by Goldman & Sachs. Although the government promised special contracts would protect tenants and employees the rents were raised significally, maintenance was reduced and whoöe company was restructured. Only 5 years after the buy-out, in February 2013, the investors started the exit via an IPO. Recently the GoldmanSachs funds sold their last shares. LEG is buying other properties and increasing rents higher than ever before

GAGFAH S.A: Luxembourg / FORTRESS LLS NYC

144.000 units, ca. 20.000 in NRW | 8 bn € total assets, 2.2. bn € equity | 1280 employees

Partial Exit of Fortress funds through IPO 2006. Principal shareholder: Fortress Investment Group LLC: 41.3 %

The current GAGFAH Group is the result of 3 major buyouts of former public housing companies by the Funds of the U.S.-investor Fortress : In 2004 Fortress bought the old GAGFAH (82.000 units) from the public pensions fund BfA. In 2005 the housing company of the Lower Saxony, NILEG, and in 2006 WOBA, the company of the City of Dresden, followed. Already in 2006 Fortress, which is famous for its tactical share deals, organized an IPO via the new holding GAGFAH S.A. in Luxembourg. Soon, “financial engineering” (several CMBS-securitizations) and the extraction for the dividends led to “asset stripping” and to a heavy reduction of maintenance. In order to get more liquidity parts of the housing stock were sold. The GAGFAH case became a scandalous main example of the bad consequences of housing privatization in Germany. For some time it looked as if it would fail to pay back the securitization loans until 2013. Thanks to low interest rates and the growing interest of stressed investors also GAGFAH finally managed to re-finance the loans and now tries to improve its economic performance, – in favor of the shareholders, not of the tenants.

Foncière Développement Logements Paris / Foncière des Régions Metz

FDL: Houses: 2335 in France, 38,614 in Germany, ca 37.000 in NRW | Assets: 0.8 bn € in France, 2.5 bn € in Germany | equity: ca. 1.3 bn € | ca. 320 employees in Germany

Shareholders FDL: Foncière des Régions 31,6 %, GMF/COVEA 19,4 %, PREDICA 15,1 %, Cardif 13,7 %, Generali 8,9

Originally a subsidiary of Foncière des Régions, the company Foncière Développement Logements (FDL) is a REIT (Real Estate Investment Trust, SIIC, specialized in housing transactions in France and in Germany. In 2006 FDL bought up the former ThyssenKrupp housing company from funds organized by Morgan Stanley and the German Corpus group. Within one year these “investors” had heavily stripped the financial capacities of the housing stocks and renamed it to “IMMEO”. Tenants struggled with single privatizations and bad repair, but in difference to other investors the work force was not radically reduced. FDL over the years carried losses of the German subsidiary. Obviously it made sense within the REIT. During the past years FDL significantly reduced its NRW-portfolio through sales to other private investors. When the city of Duisburg decided to plan a Factory Outlet Center on the land of a marvelous social housing estate, the Zinkhüttenplatz, IMMEO soon agreed to sell the land and push the tenants out. A tenant group is resisting.

BGP Investments S.A R.L. Luxembourg / BGP Holdings plc Malta

Housing units in Germany: > 25,046| Assets in housing: > 1.1 bn €, equity: 0.4 bn €

Shareholder BGP Investments : BGP Holdings plc: Bare Trust and GPT, Australia

BGP was a joint venture between the two Australian private equity investors Babcock & Brown and GPT. Financed by huge securitized loans they bought up 40.0000 housing units in Germany between 2003 and 2007, mainly workers homes and larger social housing estates in the “satellite towns” of Cologne or Munster. As a consequence of the financial crises Babcock & Brown was liquidated in January 2009. Later GPT decided to stop all business in Europe. Since then the only task of BGP is to “wind down” the business and sell the properties in order to reduce the losses of the shareholders. As a consequence the housing schemes of BGP since years are without a responsible landlord. Maintenance stopped, management often is absent. Tenants and social workers miss a responsible partner.

MIPIM, BRING BACK OUR HOMES!