Among the many financial investors present at MIPIM 2015 is the huge private equity firm Blackstone L.P., which calls itself “the world’s largest private sector owner of real estate assets”. Through buy outs of distressed subprime mortgages and other real estate assets it recently became a big landlord in the U.S. and in Spain. In both countries it is systematically raising rents. Tenants and bank tenants have started a transnational campaign against Blackstone.

After the crash of the subprime mortgage bubble in the U.S. Blackstone started to buy up cheap foreclosed family homes and rented them back to crisis affected people in need. This way Blackstone soon became one of the largest private landlords in the U.S.. Newspapers say it owns over 44000 houses.

Later, Blackstone took the chance to apply this business model to the Spanish crisis situation. Between 2007 and 2013, Spanish property prices fell by nearly 40 %. Saving banks like Caixa Catalunya lost the high amounts of value, especially of its “toxic” mortgage assets. The bankrupt banks were merged to banks like CatalunyaCaixa, nationalized with much public money and later put together into a bad bank. The bad banks as well as municipalities then started to privatize the real estate assets through global offerings. Blackstone became the most “successful” bidder in the game.

In 2013 Bloomberg reported, that Blackstone was buying up occupied low-cost housing units from local governments. Madrid’s city and regional government sold almost 5,000 rent-controlled flats to Blackstone and Goldman-Sachs. Within the bulk purchases prices per square meter were low. Soon later it was possible to sell through single purchases with very high return.

In June 2014 Caixa Catalunya (CX) sold its real estate investment platform to the Blackstone Real Estate fund for 40 billion euros. In July CX confirmed the sale of high risk loans with a nominal value of another €6.392 billion to Blackstone. More sales of mortgages are expected.

The consequences for the inhabitants are new threats of rent increase and eviction. According to Spanish law families or individuals lose their homes when they cannot pay the mortgage, but they do not lose their debts as it is usual in the U.S:. In difference to many other European countries, even individual bankruptcy is not possible in Spain. Under these conditions the handing over of formerly socialized mortgages to opportunistic international private equity funds like Blackstone, who are orientated on high returns within a short period, is like a public invitation to mass evictions and extreme misery. If the market makes it possible Blackstone will sell the houses at high prizes, which are nor affordable for the crisis affected people.

Also the consequences for affected tenants are very bad. After rental contracts have expired, landlords can demand higher rents. The conservative government made it easier for companies to evict tenants, in order to encourage private investment.

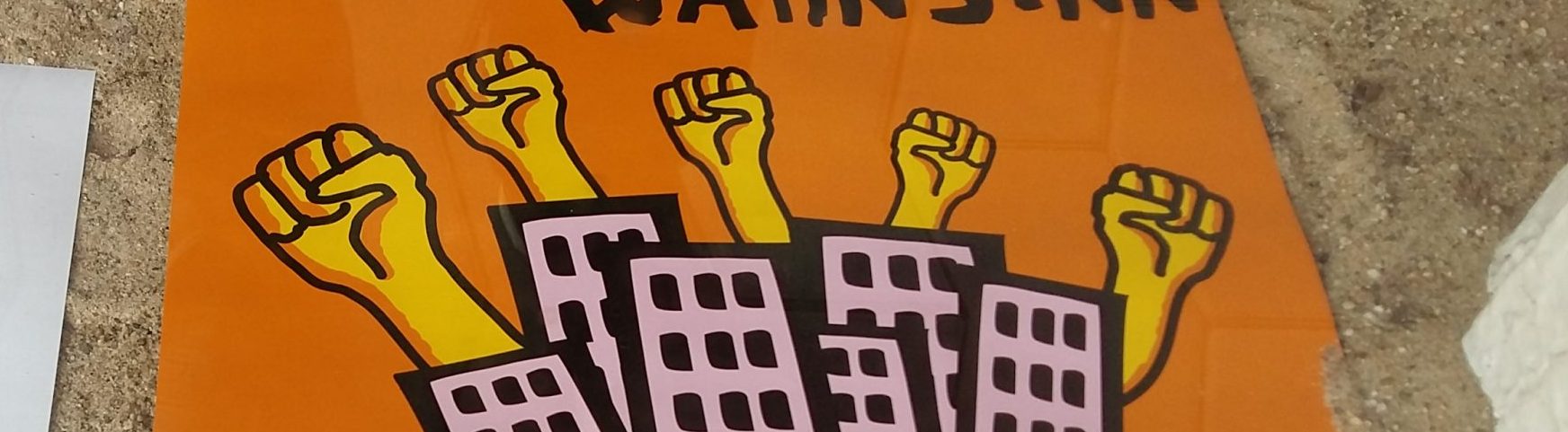

The Spanish platform of those affected by mortgage, PAH, together with allies in different countries, has started campaigning against Blackstone. After prominent actions on February 11th, they are again targeting Blackstone with a day of international action on March 17th. In Spain the PAH demands that Blackstone not buy Catalunya Caixa Bank mortgages, and not evict any of the families from the houses they have already bought in Madrid (while offering them a social rent). Each of the cities or countries participating in the action should decide their own demands. Actions in front of Blackstone offices in Barcelona, London and NYC are already confirmed.